Did Daystar’s Joni Lamb use ministry’s jet for personal trips and is that OK?

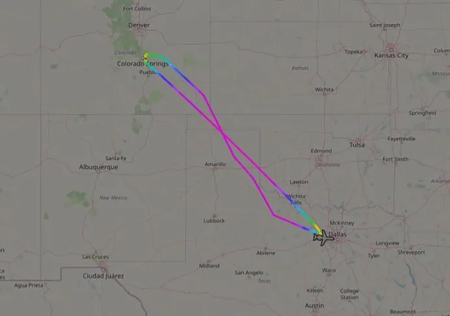

Since October 2022, Daystar Television Network’s ministry jet has made 24 round-trip flights from Fort Worth to Colorado Springs and 13 round-trip flights from Fort Worth to Destin at an estimated cost of $769,220.

The purpose of the Colorado Springs flights were a mystery until Daystar President Joni Lamb announced her engagement to Colorado Springs psychologist and author Doug Weiss in March 2023.

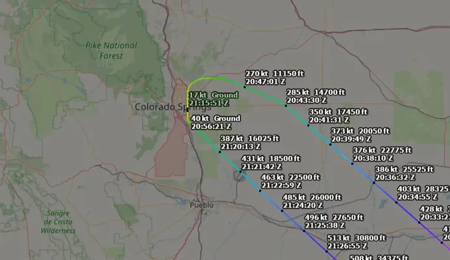

The following screenshot shows Daystar’s jet flying to Colorado Springs and returning to Texas two days after Lamb’s surprise engagement announcement. Is it appropriate for a church leader to use the ministry jet to visit a fiancé?

If the couple used commercial aircraft rather than the ministry jet for personal flights, they could have saved more than $700,000 on travel expenses.

Relationship timeline

Lamb and her late husband, Marcus Lamb, co-founded Daystar, has grown into America’s second-largest religious TV network while broadcasting televangelists who promote the prosperity gospel. Marcus died on Nov. 30, 2021.

Lamb described her husband's death in her new book, Through the Storm: “The news shot out to the world that Marcus died from COVID. He did not. He was hospitalized for COVID, was recovering, and died of heart failure.”

Two months later, Weiss filed for divorce from his wife, Lisa Weiss. The divorce was granted in May 2022.

Lamb and Weiss began dating in August 2022. “That’s when the opportunity came up for us to go to New York City — chaperoned, of course,” reports Lamb in her book.

The couple married 10 months later.

In September 2023, Lamb and Weiss purchased a beach condo near Destin for $2.9 million, which explains why the couple began flying to the Florida panhandle.

Tracking the flights

Trinity Foundation’s Pastor Planes project uses ADSB Exchange to track televangelist aircraft. Daystar’s Gulfstream G-V jet is identified by the tail number N279PH.

Daystar’s jet frequently leaves Colorado Springs and Destin less than an hour after arriving.

Under normal circumstances for a weekend trip, a generic ministry jet would land at its destination on a Friday and stay grounded until the return flight on Sunday. Instead, Daystar’s jet regularly returns to Fort Worth after reaching its destination and a few days later returns to Colorado Springs or Destin. This practice doubles the number of flights involved, so it appears the jet operates like a taxi service quickly dropping off or picking up passengers.

Dates of flights to Colorado Springs

2022: Oct. 28 and Dec. 29

2023: Jan. 2, Feb. 3, March 4 (from West Chicago), March 10, March 12, March 24, March 26, March 31, April 2, April 28, April 30, May 19, May 21, June 2, June 4, July 5, July 9, Aug. 30, Sept. 2, Oct. 18 and Oct. 22

2024: Feb. 2 and Feb. 4.

Dates of Destin flights

2023: July 29, Aug. 5, Sept. 29, Oct. 13, Oct. 16, Dec. 26 and Dec. 31

2024: Feb. 24, Feb. 28, March 13, March 17, April 9 and April 13.

Estimating the cost of private aircraft

Because Word of God Fellowship claims to be a church, the organization is exempt from nonprofit financial reporting requirements and doesn’t file a Form 990 disclosing travel costs.

However, creating estimates of travel expenses is possible due to public flight data.

According to LibertyJet, the average cost per mile for a Gulfstream G-V jet flying 200 hours per year is $19.58 per mile.

Airport Distance Calculator reports the distance from Fort Worth Meacham Airport to Colorado Springs Municipal Airport is 507 aeronautical miles.

If Daystar’s jet averages 200 flight hours per year, the cost of a flight to Colorado Springs is $9,927.06. Therefore, a round-trip could cost $19,854.12.

Therefore, a rough estimate of Daystar flights to and from Colorado Springs since October 2022 would be $476,499.

Meanwhile, Lamb has other options:

Lamb's Colleyville, Texas, home is located roughly 10 minutes from Terminal A at Dallas-Fort Worth International Airport. Meanwhile, the drive to Fort Worth Meacham Airport, where the ministry jet is kept in a hanger, is approximately 23 minutes.

Commercial flights to Colorado Springs from local airports are available through American Airlines and Southwest Airlines. The cost for an American Airlines coach round-trip ticket purchased three weeks in advance varies from almost $200 to almost $525, based on factors such as time of flight departure or proximity to a holiday.

Round-trip coach tickets from American Airlines purchased the week of the flight, while more expensive, can still cost less than $1,000 even with an extra baggage fee.

A flight from Fort Worth Meacham Airport to Destin Executive Airport is 575 aeronautical miles, according to Airport Distance Calculator. The travel costs for 13 round-trip flights to Destin are an estimated $292,721.

Southwest also offers flights from Dallas Love Field to Destin, Florida, round-trip for less than $400 if booked a couple of weeks in advance.

Colorado Springs flights

24 round-trips = 1,014 miles x 24 x 19.58 = $476,499

Destin flights

13 round-trips = 1,150 x 9 x 19.58 = $292,721

Cost of personal flights

Colorado Springs flights + Destin flights = total

$476,499+$292,721=$769,220

Estimate for cost of flying commercial

By using commercial aircraft, Lamb and Weiss would have reduced the number of flights involved. Also, this estimate does not include a trip from Chicago to Colorado Springs.

Flights to Colorado Springs

[ticket price x 2 people (Lamb and Weiss) x number of round-trip flights = total]

$400 x 2 x 13 = $10,400

Flights to Destin

[ticket price x 2 people (Lamb and Weiss) x number of round-trip flights =total]

$600 x 2 x 7 = $8,400

Total cost of tickets for flights to Colorado Springs and Destin

$10,400 + $8,400 = $18,800

Estimated savings by commercial aircraft

Cost of Colorado Springs/Destin flights – total commercial tickets = total

$769,220 – $18,800 = $750,420

*This does not consider other family members (Lamb’s son or daughters and their extended families) accompanying Lamb or other Daystar employees and board members.

Is it legal to use a ministry jet for personal use?

Yes, if a special tax is paid to the IRS. The tax, oddly named Standard Industry Fare Level, is based on a trip’s aeronautical miles.

The tax for the flights from July 1 to Dec. 31, 2022, is determined by multiplying aeronautical miles by $.1843 and adding a $44.18 terminal charge.

The tax for personal flights taken between Jan. 1 through June 30, 2023, are determined by multiplying aeronautical miles by $.2183 and adding a $52.35 terminal charge.

The tax on a round-trip personal flight from Fort Worth to Colorado Springs during the first six months of 2023 would be $273.71, if paid.

[1,014 x $.2183 +52.35 = total]

2020 'Inside Edition' exposé, buying the jet after obtaining government loan

In 2020, Word of God Fellowship purchased the jet two weeks after its Paycheck Protection Program (PPP) loan application was approved for $3.9 million. The government loan program was created to help small businesses and nonprofits retain employees during COVID-19 lockdowns.

"Inside Edition," with the assistance of Trinity Foundation, investigated the Lamb family’s personal use of the ministry jet and possible misuse of the PPP loan program.

Investigative reporter Lisa Guerrero with "Inside Edition" caught Marcus Lamb as he approached a country club for the Daystar Golf Tournament.

Guerrero: So, your church received millions of dollars in taxpayer money and then two weeks later bought a private jet for millions of dollars. Can you explain that? Did you use taxpayer money to buy a private jet?

Lamb: No, we did not. We have our own money.

Guerrero: Then what are you using that private jet for? Church business only?

Lamb: Absolutely.

Guerrero: Then why did you take two vacations with that church jet, including to Florida last week where you played golf? Your wife posted on social media that she was on vacation.

Lamb: We did have vacation, but we also did several meetings with ministers while we were there.

Marcus quickly closed the door on Guerrero.

Before the "Inside Edition" exposé aired, Daystar paid back the PPP loan.

Increasing financial accountability

The parent organizations of Daystar and Trinity Broadcasting Network (TBN) both claim to be churches, but only TBN files a Form 990 with the IRS.

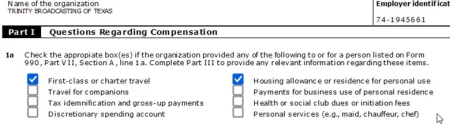

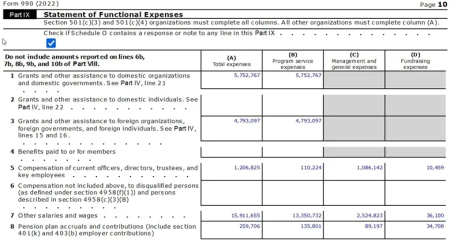

In the screenshot below, TBN reveals its use of private aircraft.

Trinity Broadcasting of Texas spent $1,991,580 on travel expenses in 2022. Again, Daystar does not disclose this information or how much money the network spent on fundraising.

Charity Navigator rates thousands of charities. One of its primary benchmarks is the percentage a nonprofit spends on program services which is determined by subtracting fundraising and management expenses from total expenses.

Charity Navigator expects charities to spend 70% or more on the organizations’ mission.

This percentage is easy to calculate for organizations filing Form 990s.

However, there is no way to effectively evaluate Daystar’s finances as the ministry no longer publishes an annual report and is not a member of Evangelical Council for Financial Accountability (ECFA).

There is a political solution to this lack of financial accountability: Congress has the power to amend the tax code and require large churches and media ministries to complete the Form 990.