Five-Step Debt Free Living Action Plan III

Steps 4 & 5

Intro

God gives you a choice to experience "Debt Free Living God's Way" as you learn to manage your resources in ways pleasing to Him. This choice takes planning. Your Five-Step Debt Free Living God's Way Action Plan is a great place to start. Step 1 is to learn to budget. Step 2 is to identify and write down your needs, wants and desires for each budget category to help make "cut-back" or "upgrade" decisions. Step 3 is to "Think Before You Buy"--God gives you a mind and he expects you to use it.

Step 4: Avoid Leverage

Leverage is when you buy something (house, car, etc) with little if any down payment. Let me be clear—the use of leverage in itself does not violate any spiritual principle I can find except when leverage leads to surety. The problem is that leverage most always leads to surety.

What is surety? Surety is taking on a debt without a clear way to repay. You buy a house using surety if you assume that if you can't make the payments you will always be able to sell it or give it back to the bank and walk away and owe nothing. It is surety if you believe the house will always be worth more than what you owe because houses "always go up" in value. Houses do not always go up in value—just ask those who had to sell in real estate "down markets" (California, Florida, Alaska, etc.).

It's the same with a car. No new car is worth what you paid for it as soon as your drive it off the lot. Many cars are only worth one-half what you paid in less than two years after you buy.

You should try to buy major purchases such as houses and cars with enough down payments so that if you are forced to sell you will not owe the lender after the sale. Owing the lender after the sale is an example of leverage that leads to surety. If you avoid leverage you will avoid surety.

So, how do you "avoid leverage" and still buy a home or car. The world teaches you to borrow what the "bank" says you can afford. The truth is that most home lenders will approve a home loan for approximately 35% more than a balanced budget can afford. So what do you do? Here is one suggestion. Live on a budget long enough to know how much you can afford to spend on a monthly basis to finance a home (principle and interest, etc.). For example, if you find that after six months of budgeting, you can afford $750 each month in rent and still have a balanced budget, you could choose to spend that same $750 (more or less) for a mortgage payment.

Then, start saving for a down payment. When you are ready to buy, ask the bank how much you can borrow based on your cash down payment AND the amount you can afford to repay ($750 per month, etc.). The amount the bank will lend for the $750 monthly repayment plus your down payment savings equals the home price you can afford.

Step 5: Practice Saving:

You need to develop the habit of saving even if you only save a small amount each paycheck. One reason to save is so that when something breaks or wears out, you can fix or replace it without borrowing.

However, some may have "good reasons" not to save. Some may say, "I can not save a lot—therefore, it is meaningless to save anything." But, according to God's Word, it is not meaningless to save small amounts. Why? Because it is the attitude that leads to the habit which is far more important than the amount. Plus, saving a little for a long time is a great way to accumulate wealth.

Some might think God frowns on a Christian who saves anything. If this is what you believe, please reconsider Proverbs 21:20, "…there are stores of choice food and oil in the house of the wise, but the foolish man devours all that he has."

I believe God's Word teaches you, even encourages you to save. Therefore, it is something you need to do as part of Your Plan of Action.

Parting Thoughts:

"Your Five-Step Financial Action Plan" is all about learning how to open the door, in faith, that God will act. God is not like the Devil. God will not force His way into your life. He comes in when you ask Him. That's what happened to me the day I was born again. I opened the door just a crack and God's mercy flooded into my heart and changed me forever. And that is how He entered to change my finances. I opened the door in obedient faith and He changed my finances forever. Do you want Him to come into your life—ask Him. Do you want Him to take over the material areas of your life—ask Him.

Throughout the Bible, every mighty exploit that was done, every time the mercy of God flooded into a situation, every time a miracle was performed, someone had to have faith. Someone had to believe God enough to act on His Word and open the door.

The same is true today. It's true for YOU today. However wide you open that door of faith is how much of God's mercy and goodness will flow into your life. He will fill up every inch you give Him. I am telling you, He is ready. He is eagerly yearning to bless you. So, do not think you are waiting of God. God is waiting on you. Why not put this Five Step Financial Action Plan into action, in faith, and see how God responds?

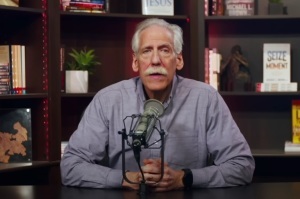

________________________________________________

Bob Louder is the Founder and President of Christian Financial Ministries (www.good-steward.org). Bob is also the author of the new best selling book, "Debt Free Living God's Way," available only on the Internet (www.debtfreelivinggodsway.org). Since 1987 Bob has helped people in hundreds of churches all across the country and in the European military community learn, understand, apply and pass on "Debt Free Living God's Way" principles and practical applications. He has represented some of the top Christian financial authors and ministries to include Larry Burkett, Dave Ramsey, Christian Financial Concepts, and Crown Ministries.

Copyright 2006 Christian Financial Ministries, Inc., All Rights Reserved. You may reprint this "Special Report" in whole or in part without permission from Christian Financial Ministries, Inc. Please credit material used to Christian Financial Ministries, Inc.