Interview: Peoples Bank CEO on Occupy Wall Street Protests, Bank Regulation

In the Occupy Wall Street protests, Republican presidential debates and halls of Congress, the role of banks has become a central concern. In an interview with The Christian Post, Chuck Sulerzyski, president and CEO of Peoples Bank, headquartered in Marietta, Ohio, shared his views on the current debate.

After the financial meltdown in 2008, there was broad agreement that the government needed to act to prevent future meltdowns, but there was little agreement between the two political parties on how that should happen. The Dodd-Frank Wall Street Reform and Consumer Protection Act, or Dodd-Frank Act, was passed by Congress in the summer of 2010 with no Republican votes in the House and only three Republican votes in the Senate.

The Republican presidential candidates have vowed reform or repeal of the Dodd-Frank Act if elected.

Sulerzyski said he supports parts of the Dodd-Frank Act and thinks regulation of the banks is necessary. “I'm pro-regulation,” and “some of what they did makes sense,” Sulerzyski said.

Sulerzyski cautioned, though, that reforms in the banking industry should keep in mind the importance of remaining competitive in a global economy.

One of the main controversies for banks with the Dodd-Frank Act is the Durbin Amendment, named after Sen. Dick Durbin (D-Ill.). The Durbin Amendment gives the Federal Reserve the authority to place a cap on the amount of money, or “swipe fee,” banks charge retailers when a customer uses the bank's ATM card for a purchase.

Transferring some of the cost of ATM transactions from retailers to banks means that banks will have to pass on the cost to consumers or reduce expenses, according to Sulerzyski.

Bank of America recently announced it would charge customers $5 per month to use its ATM cards with retailers. It said the new fee was necessary because of the Durbin Amendment.

Sulerzyski said he also worries about the Durbin Amendment. He believes that, while small banks are currently exempt from the cap, all banks will eventually be affected because otherwise retailers will steer their customers towards using ATM cards from certain banks.

Peoples Bank, a financial services company with $1.8 billion in assets and 47 locations in Ohio, West Virginia and Kentucky, is taking a different approach, Sulerzyski says.

For one type of checking account, Peoples Bank charges $6 per month but will reduce that fee by 25 cents for each purchase made with the debit card, thus encouraging the customer to use the debit card more, rather than less. Sulerzyski expects that other banks will compete by seeking creative ways to provide services to their customers, and does not expect all banks to copy Bank of America's $5-per-month ATM fee.

On Wednesday, Reps. Jason Chaffetz (R-Utah) and Bill Owens (D-N.Y.) introduced a bill in the House that would repeal the Durbin Amendment. The legislation is not expected to be voted on in the Senate or signed by the president.

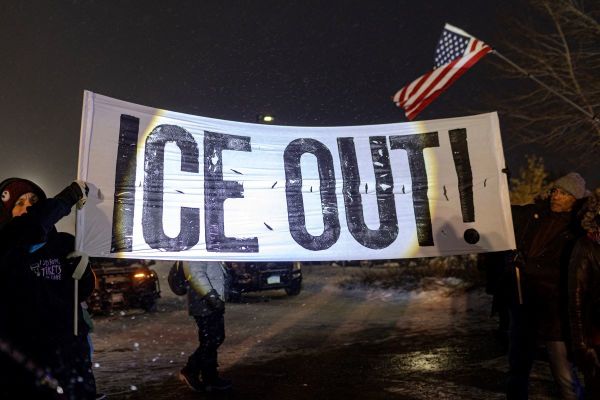

The Occupy Wall Street protesters are largely represented by liberals and the Tea Party Movement is mostly conservatives, but they share a common dislike of government bailouts. They view bailouts as nexus for Wall Street and the rich and powerful in government and Wall Street to keep their wealth and position in society.

There were two primary pieces of legislation used to prevent a collapse of the financial industry. The first, TARP I, was passed in the last few months of the Bush administration and the second, TARP II, was passed in the early months of the Obama administration.

“We will look at TARP differently 30 years from now,” Sulerzyski said. There were no easy choices at the time, according to Sulerzyski, and the options were between doing something bad, passing TARP or doing something worse – doing nothing.

Steve Sack of the Star Tribune drew an editorial cartoon that depicted some of the frustration of the Occupy Wall Street protesters. It shows two jail cells. One, labeled “Wall Street Demonstrators Jailed for Protesting,” is crammed full of protesters holding signs. The other, labeled “Wall Street Bankers Jailed for Destroying the World Economy,” is empty.

The reason no one from Wall Street is in jail, Sulerzyski said, is that there is no law against what they did. “What they did was stupid, but not illegal. You can't legislate against stupidity.”

“It's unfortunate,” Sulerzyski said, that bankers are considered the bad guys in the public imagination these days, but “some of it is probably deserved, when you look at it industry-wide.”

The banking industry should not be looked at as a single entity, according to Sulerzyski, because the large financial services companies, such as Citibank and Bank of America, are so different from what regional and community banks do. He said the smaller companies get most of their revenue by lending to local businesses.

The poor economy and the challenging regulatory environment make it difficult for the smaller banks to do well. Small businesses are not seeking to expand and thus are less in need of loans when the economy is not doing well, Sulerzyski explained.

Sulerzyski said he thinks customers should be as discerning when choosing a bank as they are when purchasing a vehicle. “Use your own antennae,” he advised, “look at what products they provide, their customer service standards and their fees.”