IRS Alleges Political Restraint Violations by 37 Churches

According to a report released last week by the Internal Revenue Service, 37 churches engaged in alleged violations of restraints on political activity during the 2004 election

Among tax-exempt groups, charities, and other civic organizations nationwide, 37 churches engaged in alleged violations of restraints on political activity during the 2004 election, according to a report released last week by the Internal Revenue Service.

Regulations currently allow churches to endorse positions, including “values” they affirm, but they cannot endorse or campaign against candidates for political office. According to IRS officials, however, there has been an increase in complaints of violations, though the report did not specify specific instances due to tax privacy laws.

Christian churches with both liberal and conservative views have spoken publicly in recent months to voice their denials of allegations from the IRS and other churches.

“It's disturbing not because it's pervasive, but because it has the potential to really grow and have a very bad impact on the integrity of charities and churches,'' said IRS commissioner Mark Everson, according to the Associated Press.

Everson added that the nature of the conduct was weighed, whether it be willful or persistent.

“We’re very careful,” he said. “What we try to do, in most cases is to work to correct the behavior going forward.”

In all, the IRS examined 110 organizations that were referred to the agency with 28 cases remaining open. Among the 82 open cases, 37 involved churches where “political intervention” was substantiated, the IRS stated.

Of three cases where the IRS deemed the violations serious enough to recommend revoking the groups’ tax exempt status, none involved churches

The report’s figures represent a small fraction of the more than one million tax-exempt organizations organized in the United States under the non-profit section 501(c)(3) of the tax law.

In November, a liberal Episcopal Church in Southern California received a letter from the IRS stating that it was at risk of losing its tax-exempt status after the church’s former Rector, the Rev. George F. Regas, preached an anti-war sermon two days before the 2004 presidential election.

In the sermon, Regas opposed both the Vietnam and 1991 Gulf Wars, imagining Jesus participating in a political debate with the presidential candidates, George W. Bush and John Kerry. He stated that Jesus would have told Bush that his “doctrine of preemptive war is a failed doctrine.”

Regas said that he believed Jesus was peacemaker who is against war and told congregants to vote according to their deepest values.

The current Rector, J Edwin Bacon of All Saints, said his church was a social action church, not a politically partisan church.

A recent development separate from the 2004 election could also place a pair of Ohio churches under IRS scrutiny.

In January, more than 30 ministers in Ohio affiliated with moderate and liberal churches petitioned the IRS to revoke the tax-exempt status of two conservative evangelical churches. The signers indicated that they were not speaking for their churches.

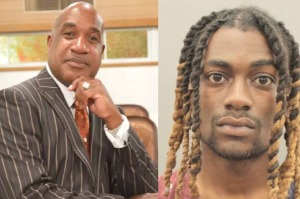

They alleged that the Rev. Rod Parsely of World Harvest Church and the Rev. Russell Johnnson of Fairfield Christian Church improperly used their churches and affiliated groups in partisan support of the Republican candidate for the governor’s office, J. Kenneth Blackwell. Both pastors hold strong views against abortion and same-sex marriage – values that Blackwell shares.

The main charges by the ministers say that the pastors’ groups have sponsored events highlighting just one candidate for governor. The pastors say they are within IRS guidelines.

"You cannot endorse from the pulpit. You cannot give money from the church. But you can stand and say pro-life and marriage issues are important to Bible-believing people. We will not take the back seat of the bus," Johnson said, according to CWNews.

Both pastors denied the allegations and said they would not change anything.

“We have no concerns whatsoever,” Parsley said.

The IRS has not indicated if it will investigate the pair of churches.