Microsoft refuses to consider downside of reverse discrimination policies

At the recent Microsoft annual shareholders meeting, a conservative investment fund, American Conservative Values Fund (Should conservative investors try to fix ESG, or destroy it?) placed a proposal on the ballot before shareholders. Investors which own a certain level of stock in a company have the authority to place resolutions on the ballot of the companies in they hold shares provided that those resolutions fulfill certain regulatory requirements. ACVF successfully proposed a resolution which asked Microsoft to produce a report on the consequences of the company's diversity, equity and inclusion (DEI) policies which includes not positive but also negative ones.

RESOLVED: Shareholders request that Microsoft issue a public report prior to December 31, 2022, omitting confidential and privileged information and at a reasonable expense, detailing a cost vs. benefits analysis of Microsoft’s Global Diversity & Inclusion efforts. A summation of this report should subsequently be included in the next annual update of Microsoft’s Global Diversity & Inclusion Report.

This concern from an investor is understandable. The CEO of the company had made public statements about changing the racial composition of the company, "We will build on our diversity and inclusion…and will double the number of Black and African American people managers, senior individual contributors, and senior leaders in the United States by 2025."

The problem with this statement is that it goes beyond the typical aspirational language which comes from corporations, an in doing so it raises serious issues about racial discrimination. After all, how can a company guarantee a certain racial composition unless it overrides merit with racial targeting? A goal is one thing, but to say "we will" raises the plausibility that a non-minority applicant may be passed over because the company has said in advance what the racial composition will be.

The issue was serious enough that the Department of Labor wrote to the company raising the issue of discrimination (Trump breaks tradition with Microsoft, Wells Fargo race inquiry) in possible violation of the Civil Rights Act. So it is understandable for shareholders to be concerned about the possible risks of such a policy.

Management opposed the policy, which is not unusual: managers generally oppose shareholder proposals. What did stand out was that the company seemed to oppose the proposal partly because of suspicions about the views of the proponents:

“In short, Microsoft…believes it is unnecessary and indeed counter-productive to single out our diversity and inclusion commitments and programs for a public justification, particularly when we believe this request is motivated by an animosity to diversity and inclusion commitments on behalf of the proponents."

So the belief that the shareholder is skeptical about the company’s DEI approach was presented as grounds to oppose the resolution. But why should skepticism be discounted? Serious policy deliberations typically involve weighing the views of both advocates and skeptics. Rejecting a request from a skeptic out of hand seems to imply that the company is pre-committed to the policy, and therefore not interested in hearing from skeptics. The board seemed to say as much in its statement of opposition: "Microsoft’s executive leadership and Board of Directors hold strong convictions that diversity and inclusion is fundamental to the Company’s long-term success.”

As of this writing, the company has not responded to the questions and concerns above. This has been a problem elsewhere in the world of ESG and proxy voting, as well. There has been a pattern, with at least one of the major proxy advisory services, of automatically categorizing proposals negatively if they do not come from the socially responsible investing community. The traditional socially responsible investing community is grounded in a particular left-of-center political point of view, and skepticism about DEI programs, particularly those which focus on equity (outcomes) as opposed to equality (opportunity), is associated with another right-of-center point of view. This means that treating DEI skeptics or others from outside of the traditional socially responsible investing community amounts to taking sides in a politically polarized world. If Microsoft's approach to racial equity is a valid one, it should be able to withstand skeptical inquiry.

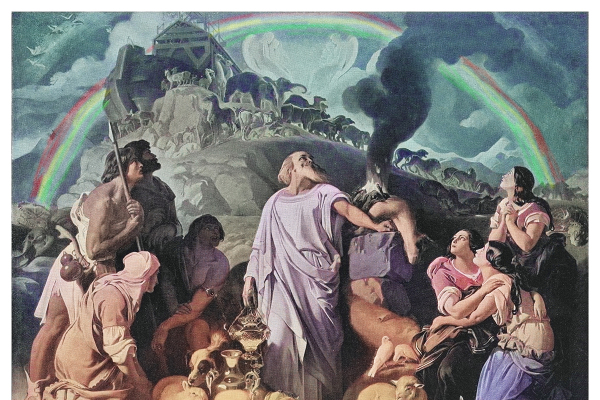

Christians, in particular, should be aware of the human tendency to be a “respecter of persons,” to judge based on what a person’s face looks like. To become judges of evil intent (Disney, reverse discrimination and "Respect of Persons").

Corporate America is now learning through backlash what it already should have known: partiality, in all its forms is unjust judgement.

Jerry Bowyer is financial economist, president of Bowyer Research, and author of “The Maker Versus the Takers: What Jesus Really Said About Social Justice and Economics.”