Credit Card Debt and Financial Woes in America

Credit card debt is a major factor in consumer financial distress. Recent statistics show that the number of American cardholders relying on their “plastic” to pay daily expenses is at an all-time high, according to a study by the Federal Reserve.

Analysts say Americans are not only relying on credit cards to pay their bill – there are also more people living from paycheck to paycheck with absolutely no savings tucked away for the future.

A report issued by Georgetown University also shows credit card debt and bankruptcy filings have skyrocketed revealing that consumers are “mired in credit card debt.”

Records show that credit cards not only have high interest rates, but they have extremely high back-end fees that are unrelated to costs, such as late fees and overlimit fees, plus a host of billing tricks and traps that function as hidden price points.

These “tricks and traps” generate more than $12 billion in revenue for the card industry, which is more than 30 percent of the industry’s pre-tax profits.

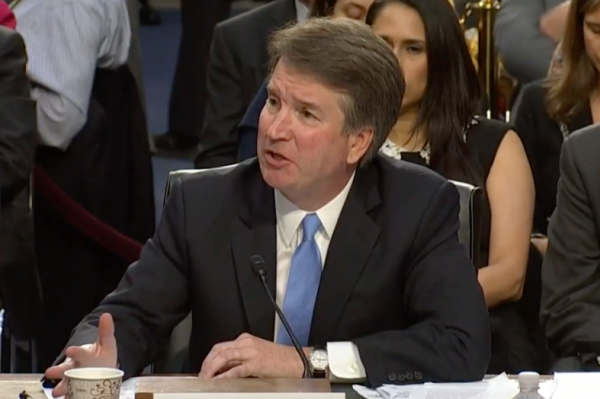

Dr. Adam J. Levitin, an associate professor of law at the Georgetown University Law Center, in Washington, D.C., said credit cards are, in many respects, an excellent product because they are an easy source of financing.

“But, credit cards are also a product that can be misused by both consumers and card issuers. Consumers can use cards irresponsibly, and banks can issue cards and extend credit limits irresponsibly,” Levitin said to Congress in an effort to create better industry legislation.

“Unfortunately, credit card business models and product design encourage unsustainable and irresponsible lending that leaves consumers buried in debt and hurts responsible creditors like small businesses, landlords, tort victims, and the government.”

The credit card nightmare does not end there. The latest statistics from the Federal Reserve indicate the total amount of consumer debt in the United States stands at nearly $2.4 trillion.

Based on the 2010 Census statistics, that works out to be nearly $7,800 in debt for every man, woman and child that lives here in the U.S.

According to information gathered by the U.S. Census Bureau, there were more than 173 million credit card holders in the United States in 2006. That number has grown to some 181 million Americans.

These same Americans own approximately 1.5 billion cards, an average of nearly nine credit cards issued per credit card holder, according to the Reserve's report.

Adding the fact that there is an increasing number of unemployed Americans and the country's economic woes have resulted in more delinquencies on credit card payments and home equity loans.

“Basically, all Americans, and people in other countries, are falling behind on paying their bills,” said Cindy Craft, an instructor on economics.

“People cannot make ends meet. They are frustrated and that results in family tensions, divorce rates and general health problems.”

Americans charged more than $2.5 billion to their credit cards last year, which is nearly $13,000 per cardholder. Statistics also show that bankruptcies are increasing every year due to debt versus income issues.

More than 87 percent of consumer bankruptcy filers have credit card debt when they file, according to the Federal Reserve.

Research shows that consumers spend roughly 12 percent of their disposable income to pay off mortgage obligations and consumer debt such as automobile and personal loans. In other words, mandatory obligations.

As of December 2010, these financial obligations stood at some 15.27 percent for homeowners and 23.99 percent for renters. Nationally, including all groups, this number stands at 16.78 percent.

What this data tells us is that the typical homeowner spends around 15 percent of their disposable income just to own their homes and drive their cars. Renters outpace homeowners by over 8 percent, and spend nearly 24 percent of their income on these same types of debts.

Liz Weston, an advisor for Money Talk, said if people cannot pay off their credit card debt, then they are living beyond their means and cannot afford their current lifestyle.

“Carrying credit card debt has always been foolish, of course,” she said.

“Furthermore, you're vulnerable to the changing whims of credit card companies, and those whims can have serious effects on your perceived creditworthiness.”

She advises paying down balances, which may not boost credit scores right away if your lenders continue to slash available credit. “This is an industry practice known as 'chasing down the balance' but you need to do so anyway to free yourself of this toxic debt,” she said.

Here is help:

The Federal Reserve’s Credit Card Repayment Calculator website has a calculator to help you estimate of how long it will take you to pay off your credit card balance. Visit on the web: http://www.federalreserve.gov/creditcardcalculator/

Here is more help:

To build up your credit score review your credit report. Make sure that all the information on the report is being reported accurately. If there are errors, you have a right to dispute any inaccuracies with the credit reporting agencies.

Here are 5 key points to help increase your score:

- Pay your bills before the statement dates. Even if you pay off your balances each month it can still roll over on the credit report depending on the date the creditors report to the credit reporting agencies. By paying your bills early it may fall into the cycle where it will show a zero balance.

- Keep all your balances below 30 percent of the credit limit.

- Make multiple payments. By making more than one payment each month on your credit cards, the balance will go down and will help increase the score.

- If you have some accounts that are negative such as slow payments, contact your lender and ask for a “good-will deletion.” Some of the creditors will correct the negative entry to a positive entry.

- Ask a collection agency to remove a negative entry off your report upon receipt of your payment. Get a letter from them first before you send any money.

Note: In the eyes of a lender, a good debt-to-income ratio is 33 to 38 percent.

Source: Economic: Mary Ann Milbourn