Top Healthcare Companies Avoid Obamacare Exchanges

Three of the richest healthcare insurance companies in America are reluctant to join the state exchanges under the Affordable Care Act, also known as "Obamacare." One expert believes their minimal participation will contribute to making the Obamacare plan in the exchanges essentially the same low quality as Medicaid.

"Most people will be outside the market, mostly in employer provided coverage," Edmund Haislmaier, senior research fellow in Health Policy Studies at the Heritage Foundation, told The Christian Post on Monday. This employer coverage, Haislmaier explained, is the service in which United HealthCare, Aetna, and Cigna — the three with a minimal presence in the exchanges — specialize.

All three rank in the top five healthcare companies in CNN Money's Fortune 500 list, along with WellPoint and Humana. Each company provides most of its business in administrative services, Haislmaier said — 61 percent for Aetna, 54 percent for United HealthCare, and 84 percent for Cigna. In these plans, the employer bears the risk and the insurer merely administers it.

"While Cigna is a leading U.S. health insurer among employer-paid health plans, we have only been in the individual and health plan space for 4-5 years, in just 10 states," Cigna's public relations director, Joe Mondy, wrote CP in an email statement. He listed the states in whose exchanges Cigna will participate: Arizona, Colorado, Florida, Tennessee, and Texas. It will continue to offer individual and family plans off the exchanges in California, Connecticut, Georgia, and North and South Carolina.

Mondy assured CP that Cigna's 2014 individual plans are "ACA-compliant both on and off the exchange — and specifically designed to meet the unique needs of both marketplaces now and in the forseeable future."

Despite this limited involvement in the exchanges, the spokesman said "Cigna is committed to delivering on the promise of health care reform." Among the advantages of reform, he listed "affordable access to quality health care from the best local doctors and medical facilities, easy to understand plans and information, resources and service to improve the health, well-being, and sense of security of individuals and their families."

Susan Millerick, director of communications at Aetna, made similar commitments in explaining her company's decision to withdraw from at least five exchanges. In deciding which exchanges to join, Aetna "focused our on-exchange participation to the markets where we can be most competitive and deliver the greatest value to our customers."

Millerick admitted that Aetna withdrew plans to participate in certain state exchanges during the summer, she declared that the company is "participating on exchanges in all or portions of 17 states across the country." These decisions were not made lightly, Millerick explained, "and followed an extensive review of Aetna's overall company strategy." While Aetna chose to opt out of the exchange in its home state of Connecticut, she explained it will still be able to operate off the exchange.

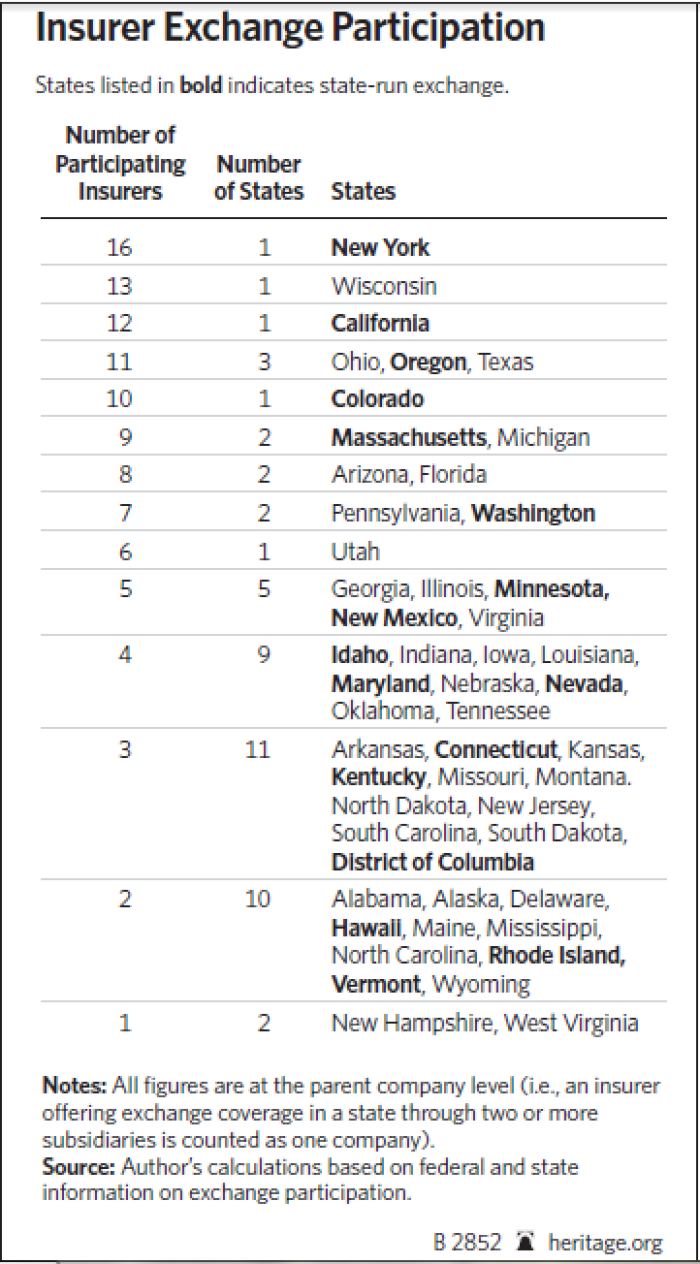

Insurance will still be legally available outside the exchanges, but Obamacare subsidies only apply within them, Haislmaier explained. "There is virtually no participation by individual market insurers in the exchanges," he added – "they just don't see it as an attractive business opportunity." These insurers tend to be small and expect exchanges to have high claims costs, and so avoid them.

On the other hand, Haislmaier explained that insurers "whose primary business is Medicaid-managed care" are joining the exchanges.

The scholar estimated that the exchanges will end up floosed with "particularly older, poorer people, who get coverage at very little cost but have very limited access to providers," hardly the healthcare dream the President waxed eloquent about. "It's a kind of Medicaid expansion by another means," Haislmaier said.

United HealthCare did not respond to requests for comment by press time.