Ask Chuck: Big spenders run into big problems

Dear Chuck,

My wife and I started over-spending after receiving a big raise. Since then, we have realized how wasteful we’ve become with God’s money. We are worried about living without a safety net. What steps would help us get back on track?

Big Spenders

Dear Big Spenders,

You may not know that what you have described is one of the most common financial mistakes anyone makes — increasing your lifestyle with every increase in income. Don’t heap too much guilt on yourselves; it is a very hard challenge to even notice. For many, this ever-increasing lifestyle is the proverbial frog boiling in the pot — by the time he realizes his mistake of resting in the warm, cozy water, it is too late.

Get disciplined

Discipline is the ability to say “no” to what you want today so you can say “yes" to what you need tomorrow. Let me give you an example that will relate to your challenge. In 2015, I decided to drink only water for the entire year ... no coffee, tea, juice, soda, smoothies, or lattes. Nothing but H2O! For full disclosure, I made it the entire 365 days and felt so good. My only deviation was an occasional water with carbonation.

What difference did it make? For one, it helped my budget! I broke the habit of buying coffee or tea at the airport or for meetings. Cutting sugar and caffeine also caused me to enjoy water, sleep better, and improve my overall health. We can apply that same type of thinking to our finances.

Small decisions can make a walloping impact on our financial health. Here are five basics that can help everybody. They are my personal favorites.

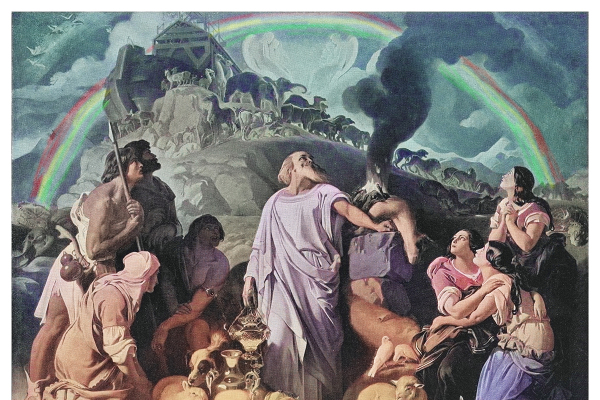

Honor God off the top

Right now, you are honoring someone or something first with your finances. It might be the government, Amazon, your mortgage lender, your landlord, or your utility company, but someone is getting the first portion of your income. Replace whoever or whatever is currently first by giving off the top of every source of your income to your church and other ministries that build His Kingdom.

If you cannot give a full 10%, which I think is the appropriate beginning standard, start with what you can do cheerfully. Increase the amount as you are able and see what a difference it makes in your life. “Trust me on this one!” These are God’s words paraphrased from Malachi 3.

Save something from every paycheck

Pick a day and declare, “No more! I will not go another month without saving something from my next paycheck!” Make the decision and then start saving something — no matter how small the amount. Save something from everysinglepaycheck or any other source of income. Resolve not to spend everything you have by setting up automatic deposits into a savings account. This habit will make you wise like the ant from Proverbs 6:6. Little by little, you will have money saved for emergencies, stress will go down, and financial stability will become a reality.

Stop getting tax refunds

People celebrate tax refunds as if Uncle Sam is rewarding them for their good behavior! While I never like to discover that I owe the IRS money, I don’t like to get a tax refund either.

Let’s say you receive a refund of $3,600. That means you loaned the US government $300 a month for an entire year and waited for them to reimburse you without interest.

By adjusting your withholding or quarterly payments, you pay only what you owe or expect to owe — nothing more. This grants a steady cash flow while also providing funds for giving and saving each month.

Use cash

Study after study proves that we spend more using plastic. Using cash makes us more aware of when and where our money goes.

It may sound like going back to the Depression era, but the old-fashioned way of cashing a payroll check, dividing the cash into budget categories, and putting the money in an envelope will never go out of style because of its effectiveness! It works! Consider using cash for groceries, Costco, Sam’s, and any place you are tempted with impulse buying. If you usually overspend at restaurants, take a limited amount of cash.

Some people I know, who are really great with money, continue to use the envelope system, though they no longer need to. They say that it allows them to spend worry-free!

Reduce expensive debt

Start with a fresh outlook on debt. Ask yourself, “Do I really have to be in debt?”

Far too many people jump from one debt to another and from one card limit to another. They cannot comprehend the freedom of being debt-free. That is why I emphasize paying off the most expensive debt first. Get one paid off. Then do it again ... and again ... and again. The major payoff is freedom — freedom from worrying about the future, about income, and about making it to the end of the month. Check out the snowball and avalanche methods of eliminating debt, or get in touch with Christian Credit Counselors.

Summary

These five basic steps will change your relationship with God, your financial well-being, your relationships, and much more! But allow me to add one more: implement a budget. It’s a tool that is designed to help you through thick and thin and protect you from wasting what God provides.

“Moreover, it is required of stewards that they be found faithful” (1 Corinthians 4:2 ESV).

I’d like to invite you to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that will help bring God’s Word into your daily life.

Chuck Bentley is CEO of Crown Financial Ministries, a global Christian ministry, founded by the late Larry Burkett. He is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Economic Evidence for God?. Be sure to follow Crown on Facebook.