Ask Chuck: Should I wait to buy a used car?

Hi Chuck,

When do you think used-car prices will drop? My car is racking up a lot of miles, and I am trying to hold off on buying a replacement.

Waiting on Prices to Drop

Dear Waiting on Prices to Drop,

Several years ago, a neighbor told my wife they needed to buy a new car because theirs had nearly 100,000 miles on it. Ann chuckled, thinking, “That’s the kind we try to buy.” Many, like you, are “racking up a lot of miles” waiting for used-car prices to drop! It is hard to know when the prices will come down, but let’s look at what some experts say.

Watch new-car production

J.P. Morgan expects demand for used cars to moderate as new-car production ramps up.

New-car prices are up due to global supply chain issues, the ongoing chip shortage, and rising raw materials costs exacerbated by the Russia/Ukraine war. Dealer Trak estimates that sales in the used-car market fell 13% year-over-year in June 2022. “This is driven by the high prices and historically poor selection that has been plaguing the industry but is likely now joined also by declining demand given waning consumer confidence, asset price deflation, rising interest rates, and slowing economic activity. A deteriorating macro (economic) outlook is weighing on consumer sentiment and keeping potential buyers out of the market,” says Ryan Brinkman, lead automotive equity research analyst for J.P. Morgan.

Used-car prices softening

Used-car and truck prices are falling slightly. Prices are still up over 7% from last year, but experts believe that may be coming to an end. Charlie Chesbrough, Cox Automotive’s senior economist, says, “We are starting to see prices come down. But it’s very hard to see vehicle prices collapsing in this market because there’s still just a whole bunch of need out there for transportation.” He believes prices will stay elevated due to the limited number of cars available for consumers over the coming years. Why?

- Dealers have leased fewer new cars since the pandemic began. These cars typically join used inventory when their leases expire. Fewer leased vehicles mean fewer used cars on the market.

- Used vehicles provide income for millions of Americans who work for ride-share delivery services. They are not likely to sell their vehicles.

- If we enter a period of recession, fewer Americans will be able to afford new vehicles. This will increase competition in the used-vehicle market.

Ivan Drury at Edmunds says, “Typically about 20% of consumers would buy their lease instead of turning it in. Now we’ve heard some reports that 90% of consumers are buying. Ford put out that number, and it blew my mind.” This could impact the number of used vehicles coming to market in the coming years.

Slumping new car sales means fewer trade-ins, which will impact the supply of used vehicles.

J.D. Power’s David Paris notes that over the past decade, there has been an increased demand for used vehicles. In the past, buying a used vehicle was “frowned upon.” That changed over the past decade, causing a demand for used cars. “So we don’t think this is going to be a bubble bursting, with prices falling extremely rapidly,” he said.

Nine months to 2 years?

Ivan Drury at Edmunds.com believes that if consumers can wait nine months or a year, the market may bottom out. According to J.D Power’s Paris, “Over the course of the next two years, we’re going to see used car prices retreat back to more normal levels. So, by the time we get to 2025, that’s really when used prices will bottom.” Paris and Drury both see used-car prices bottoming (at around $25,000 ) in two years, $5,000 above average prices in 2019. Because so many consumers are waiting to buy, values will stay up until supply increases significantly.

The big picture

New-car sales are impacted by the following:

- High gasoline prices.

- Rising interest rates.

- Chip shortage and supply chain problems.

- Raw material costs increasing due to Ukraine/Russia war.

This is driving new-car consumers to the used-car market.

Used-car prices are impacted by the following:

- Low inventory challenges.

- Higher demand due to new-car prices.

Hurricane Ian flooded thousands of cars. Cox analysts report that 80% of replacements may come from the used-car market, further complicating availability. In addition, unscrupulous sellers will buy damaged vehicles at auction, move to a different state with different title requirements, and retitle them to hide the trail of flood damage. Know how to recognize a flood-damaged car.

Consider your options

If you are driving an older car, consider making repairs in order to drive it longer. Fixing a dependable vehicle will save you time and money in the long run. Consumer Reports suggests conducting a cost/benefit analysis. Simply divide the estimated cost of repairs by the number of months you think you can get out of the car. If that number is less than a new monthly payment, it will be worth it. If not, you may need to find a more reliable vehicle.

Demand for car repairs has increased now that consumers are holding on to their cars. Shop around because the demand and supply-chain issues have caused higher prices and longer waiting times for parts. “A $3,000 repair bill is probably a better financial move than committing to a monthly $500 car payment over the next several years, to say nothing of sales tax, registration fees, and the likelihood of higher insurance premiums on a newer car,” Consumer Reports states.

Our late founder, Larry Burkett, used to say, “I drive a car till it turns to dust, then I sweep up the dust and ride on the dust.” To maximize the life of the car you drive:

- Keep up with routine maintenance.

- Research repair shops.

- Ask shops about 90-day financing if needed. Compare it to carrying a credit card balance.

Don’t rush. Seek the wisdom and counsel of those you trust and pray as you wait. The Lord is “wonderful in counsel and excellent in wisdom” (Isaiah 28:29, ESV).

To gain more wisdom and insight into how you can effectively steward God’s resources—both time and money — the Crown Stewardship Podcast can be valuable. You can subscribe for alerts of new episodes. I hope you find it beneficial.

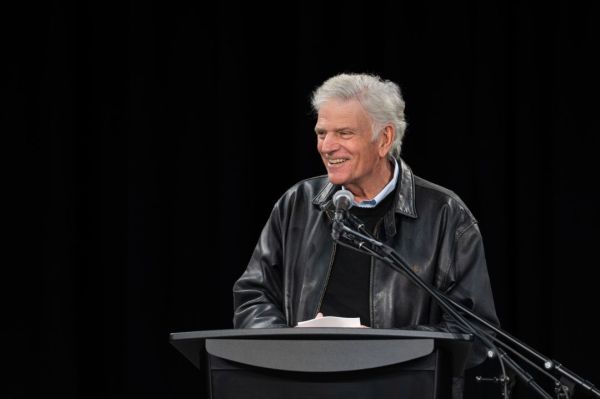

Chuck Bentley is CEO of Crown Financial Ministries, a global Christian ministry, founded by the late Larry Burkett. He is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Economic Evidence for God?. Be sure to follow Crown on Facebook.