Ask Chuck: Will Bitcoin fever pan out?

Dear Chuck,

I thought Bitcoin was a joke until now. My wife and I are thinking of putting some of our retirement funds into it but wonder if we are too late? Maybe gold is better?

Bitcoin or Gold

Dear Bitcoin or Gold,

Gold Fever was the term for the mass migration of fortune seekers to California from 1848 to 1853. As we know from history, more money was made by the vendors serving the gold miners than the vast majority of those doing the hard work. The question on millions of investors' minds right now is similar to yours: Is it too late, or could it be a great time to jump in and buy Bitcoin or a related investment at this historic price level? In some ways, we are witnessing what we could call Bitcoin Fever. Let’s see what Michael Finke, the Frank M. Engle Distinguished Chair in Economic Security at The American College of Financial Services, said in a recent Yahoo Finance article:

“People tend to get attracted to things that have gone up recently,” Finke said. “And that’s attractive to anybody who’s investing, but particularly those who tend to be more sentiment-driven investors. They see the price go up and they think they want to be part of it. There’s always that fear of missing out.”

I am not against gold or Bitcoin; I have written numerous times about both in the past. You can read the articles here and here. However, I am against making speculative, reactionary decisions instead of measured investments. FOMO, or “fear of missing out,” is a very real fear that prompts people to follow the crowd. I think you are wise to be asking questions. Let’s get some context, and then I will offer my advice.

Bitcoin and gold soar

Bitcoin (BTC-USD) continues to shatter records in 2024 after a brutal crypto winter that began two years ago. The world's largest cryptocurrency reached beyond $107,000 for the very first time early in the morning on December 16. Bitcoin’s record price puts it up about 53% since the presidential election in November! Gold has also had impressive growth in 2024. On January 1, gold was trading at $2,063.73 per ounce. Fast forward to December 16th, and the price soared to $2,670 per ounce. This represents a remarkable growth of 31% this year. So, both gold and Bitcoin have had spectacular returns this year.

Bitcoin is far more volatile than the overall stock market. That can be exciting when the price is on a tear, like the one we’ve seen in recent months. But when times are bad, Bitcoin’s price often takes a much harder fall compared to stocks. Take 2022, which was, in general, an awful year for stocks, with the S&P 500 plunging around 19%. In the same year, Bitcoin lost over 60% of its value. Gold tends to move at a slow and steady pace. While not driven by manufacturing demands, it has historically been viewed as a safe store of value.

But what is driving the current growth of both, and will it continue?

What is causing Bitcoin and gold to increase so rapidly?

- Market sentiment: Presidential elections can influence market expectations, especially around economic policies, regulations, or fiscal spending, which may drive interest in decentralized assets like Bitcoin. Many believe that the federal government, under the Trump administration, will add up to a million Bitcoins as a part of the Treasury Department’s strategic reserve. This would be a key factor in driving demand and adoption to even higher levels.

- Inflation hedge: Investors may view Bitcoin and/or gold as a hedge against potential sustained or increasing inflation.

- Institutional investment: Post-election clarity often reassures institutional investors, and any increased involvement from major financial players can boost Bitcoin prices.

- Dollar weakness: Investors may continue to flock to Bitcoin and/or gold as an alternative store of value if the U.S. dollar weakens or government spending and run-away debt is not curtailed.

- Broader crypto adoption: The election may coincide with the increasing mainstream adoption of cryptocurrencies, which contributes to upward momentum.

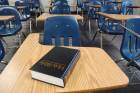

Does the Bible address the issue?

The Bible gives us numerous principles to follow in answer to your question:

- Gather advice: “Plans fail for lack of counsel, but with many advisers they succeed” (Proverbs 15:22 NIV). “The way of a fool is right in his own eyes, but a wise man listens to advice” (Proverbs 12:15 ESV).

- Don’t speculate: “The plans of the diligent lead to profit as surely as haste (quick speculation) leads to poverty” (Proverbs 21:5 NIV, parentheses mine).

- Always diversify: “Give a portion to seven, or even to eight, for you know not what disaster may happen on earth” (Ecclesiastes 11:2 ESV).

- Gold will not save you: “Your gold and silver have corroded, and their corrosion will be evidence against you and will eat your flesh like fire. You have laid up treasure in the last days” (James 5:3 ESV).

- Check your motives: “But those who desire to be rich fall into temptation, into a snare, into many senseless and harmful desires that plunge people into ruin and destruction” (1 Timothy 6:9 ESV).

My advice

Bitcoin and other cryptocurrencies are speculative investments (like gambling), which are assets that people put money into hoping the price will rise rapidly. Gold investments tend to experience slower but steady growth through the years. If you and your spouse are in agreement, move a small percentage of your retirement funds into a gold and Bitcoin ETF, but don’t plan on striking it rich; it could turn into fool’s gold overnight.

I’d like to invite you to join a free Crown Bible study on the YouVersion app. We have several devotionals regarding money and stewardship that will provide encouragement by bringing God’s Word into your daily life.

Chuck Bentley is CEO of Crown Financial Ministries, a global Christian ministry, founded by the late Larry Burkett. He is the host of a daily radio broadcast, My MoneyLife, featured on more than 1,000 Christian Music and Talk stations in the U.S., and author of his most recent book, Economic Evidence for God?. Be sure to follow Crown on Facebook.